Rating: 5. Reviewer: FICO® Credit Score - Item Reviewed: FICO Credit Score Free from myFICO - Support by: FICO® Credit Score. FICO® Credit Score is a free fico credit score that most creditors use to resolve your credit risk - learn how to check my fico credit score for free and get free credit report fico score fast and easy..

What is myFICO?

MyFICO is a FICO consumer division. Since its introduction over the past 25 years ago, FICO® Credit Scores has become the global standard for measuring credit risk in the mortgage, banking, car industry, creditcard and retail industries. 90 out of 100 major U.S. financial institutions utilized FICO Credit Scores to make consumer credit decisions.How To Check My FICO Credit Score for Free?

10 Easy Question to Get Your FICO Credit Score Range

1. How many credit cards do you have? (chose one: 0, 1, 2-4, or 5+ than..)* How long ago did you get your first credit card?

please chose one:

** less than 6 months ago

** 6 months – 2 years ago

** 2 – 4 years ago

** 4 – 5 years ago

** 5 – 8 years ago

** 8 – 10 years ago

** 10 – 15 years ago

** 15 – 20 years ago

** 20+ years ago

in example I pick: 1 and 6 months - 2 years ago.

2. How long ago did you get your first loan? (i.e., auto loan, mortgage or student loan, etc.)

please chose one:

* Never

* less than 6 months ago

* 6 months – 2 years

* 2 – 5 years

* 5 – 10 years

* 10 – 15 years

* 15 – 20 years

* 20+ years

in example I pick: 10 - 15 years ago.

3. How many loans or credit cards have you applied for in the last year?

(pick one: 0, 1, 2, 3-5, 6+)

in this case I pick: 0.

4. When was the last time you opened a new loan or credit card?

* less than 3 months ago

* between 3 – 6 months ago

* more than 6 months ago

in this case I pick: more than 6 months ago.

5. How many of your loans and/or credit cards currently have a balance?

(pick one: 0–4, 5–6, 7–8, 9+)

in this case I pick: 0 - 4.

6. Besides any mortgages, what is the total balance on all your loans and credit cards combined?

* I have only mortgage loan(s)

* less than $500

* $500 – $999

* $1,000 – $4,999

* $5,000 – $9,999

* $10,000 – $19,999

* $20,000+

As an example, let's say you have two accounts:

- One auto loan with balance of $7,000

- One credit card with balance of $1,500

Your total balances on all non-mortgage accounts would be: $8,500 ($7,000 + $1,500).

in this case I pick: $1,000 - $4,999.

7. When did you last miss a loan or credit card payment?

* Never

* in the past 3 months

* 3 – 6 months ago

* 6 – 12 months ago

* 1 – 2 years ago

* 2 – 3 years ago

* 3 – 4 years ago

* 4+ years ago

in this case I pick: in the past 3 months.

What is the most delinquent you have ever been on a loan or credit card payment?

(includes repossessions, foreclosures, and accounts referred to collection agencies)

** 30 days

** 60 days

** 90 days

** 90+ days delinquent

in this case I pick: 30 days.

8. How many of your loans and/or credit cards are currently past due?

(pick one: 0, 1, 2 or more)

in this case I pick: 1.

What are your total balances on all currently past due accounts?

** less than $250

** $250 – $499

** $500 – $4,999

** $5000+

in this case I pick: $250 - $499.

9. What percent of your total credit card limits do your credit card balances represent?

* I've never had a credit card

* 0% to 9%

* 10% to 19%

* 20% to 29%

* 30% to 39%

* 40% to 49%

* 50% to 69%

* 70% to 89%

* 90% to 99%

* 100% or higher

As an example, let's say you have two credit cards:

- One with balance of $273 and limit of $1,000

- One with balance of $737 and limit of $4,000

Your total credit card balances would be $1,010 ($273 + $737), your total credit limits would be $5,000 ($1,000 + $4,000), and the percent of your total credit limits that your credit card balances represent are: $1,000 divided by $5,000, or 20%.

in this case I pick: 70% to 89%.

10. In the last 10 years, have you ever experienced bankruptcy, tax lien, foreclosure, repossession or an account in collections?

YES or NO

in this case I pick: NO.

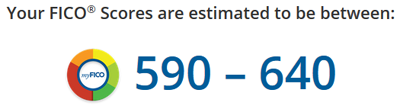

and the results is...

See the exactly info about the bad and or good credit score on the lastest post about: Free Credit Report FICO Score.

Are you interested in trying it yourself? Please use FICO Credit Scores estimator for free from myFICO.

Click here to Estimate your FICO Credit Scores.

0 Response to "FICO Credit Score Free from myFICO"

Post a Comment