Rating: 5. Reviewer: FICO® Credit Score - Item Reviewed: Free Credit Report FICO® Score - Support by: FICO® Credit Score. FICO® Credit Score is a free fico credit score that most creditors use to resolve your credit risk - learn how to check my fico credit score for free and get free credit report fico score fast and easy..

What is FICO® Credit Scores

FICO® Credit Scores are ascertained just on the premise of information in consumer credit reports put away in credit reporting agencies.By contrasting this data and examples in a huge number of past credit reports, FICO® Credit Scores foresee your future credit risk level.

What is a Credit Score?

The credit score influences the accessible credit and terms (interest rate, and so forth.) that might be offered by the lender. This is an imperative piece of credit wellbeing.At the point when buyers apply for credit - whether for credit cards, car loans, or home loan banks need to realize what risks they take by lending cash. At the point when lenders arrange credit reports, they can likewise buy credit score in view of data in the report. Credit scores help creditors evaluate to assess credit reports in light of the fact that these are numbers that condense credit hazard, in view of a credit report scrap at a given point in time

It is essential to comprehend that not each credit score offered available to be purchased online is a FICO® Credit Score.

What is a good credit score?

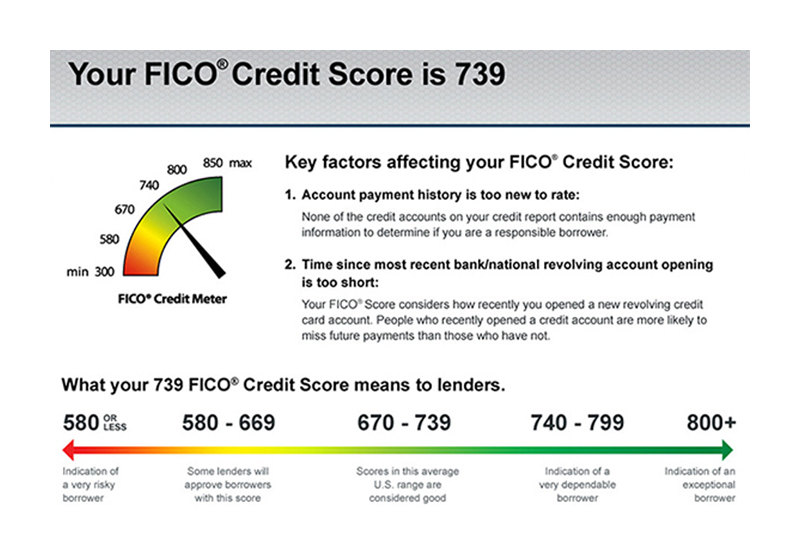

FICO® Base scores have a score range of 300-850. The higher the score, the lower the hazard. In any case, there is no an incentive to state whether certain individuals will be "good" or "terrible" clients.While numerous lenders utilize FICO® Credit Scores to enable them to settle on lending choices, every moneylender has his own methodology, including an adequate level of risk for a specific credit item. There is no single "cutoff score" utilized by all lenders and there are numerous extra factors that moneylenders use to decide your real interest rate.

Reason for your credit score

In the event that the FICO® Credit Score is ascertained from your credit report, the credit reporting agency will likewise provide up to five reasons that most influence a particular score. This reason is generally negative, because that is the reason behind why the credit score is not higher.Minimum required to calculate FICO® Credit Score

For the FICO® Credit Score to be ascertained, your credit report from an authority whose esteem is being computed ought to contain enough data - and a considerable amount of current data - on which the credit score is based. Generally, that implies you should have no less than one account that has been open for six months or more, and no less than one account that has been reported for to the credit bureaus over the most recent six monthsYour FICO® Credit Score will change over time

Since the data in your credit report changes, at that point there will be another credit score in light of your credit report. So your FICO® Credit Scores from the previous month may not be an indistinguishable value from the lenders of the present credit bureausOther credit score

While FICO® Credit Score is utilized by 90% of best top lenders, there are some other credit scores accessible to consumers. Other credit scores may assess your credit report uniquely than FICO® Credit Scores. When obtaining a credit score for yourself, most specialists prescribe getting a FICO® Credit Score, coz FICO® Credit Score is utilized as a part of 90% of loaning choicesShould To Know

Before deciding what number of (or little) FICO® Credit scores are essential to you, it's great to know FICO® Credit Scores, what components frame the FICO® Credit Score and how FICO® Credit Score is utilized.FICO® recovers credit data from three noteworthy credit reporting agencies and utilizations it to dissect and figure your FICO® Score. Because of the way that agencies may get different creditor information at various circumstances (or none at all), you might not have the same FICO® Credit Score in every agency. However, the ramifications of each FICO® Credit Score are the same: it predicts the conduct - that you are so liable to pay the bill on time and on the off chance that you can deal with the credit line increment.

5 elements make up your FICO® Credit Score, each having a percentage impact on your FICO® Score:

- Payment History (35%)

- Debt / Amount Owe (30%)

- Length of Credit History (15%)

- Credit Mix (10%)

- New Credit (10%)

FICO® Credit Score 8 is the most broadly utilized variant of scores by lenders to decide. It will tumble to the range of 300 - 850. The higher the Score, the all the more "decent credit" you show up, which implies the lender will tend to offer your credit. A higher FICO® Credit Score can likewise prompt lower interest rates because the lender has a higher assume that you will pay off the loan / credit and take on less.

Why is FICO® Credit Score important to you?

Are you planning on applying for a mortgage... issuing an auto loan... applying for a credit card? Lenders need to know what risks they take if they decide to lend you money. What better way to learn this information than to look at your past financial performance? Things curious lenders include:

- Have you paid / did you pay your bills on time?

- Have you ever had bankruptcy issues or debt collection issues?

- How much money do you owe?

- Do you have a long and solid credit history or just recently?

- What kind of credit do you have now - revolving credit? Loan installment?

- Have you applied for a long time recently?

The FICO® credit score provides many answers to these questions. And since the top 90% of lenders use FICO® Credit Scores to make decisions, FICO® Credit Scores are likely to be important to you if you are in the market to buy a house, car or apply for a loan.

As mentioned earlier, the FICO® Credit Score not only consequence the lender's conclusion to lend (or not lend), but it can also affect the interest rate that will apply to you. For example, when you check the MyFICO® Loan Savings Calculator, you will see a fixed 30-year mortgage rate difference based on the FICO® Credit Score range (per 15/14/16):

| FICO® APR | Score |

| 760 - 850 700 - 759 680 - 699 660 - 679 640 - 659 620 - 639 |

3,179% 3,401% 3,578% 3,792% 4,222% 3,768% |

As you may know, a small interest rate increase, even a tenth of a percent, can increase interest payments over time by thousands of dollars. This is one of the main reasons why it's so important to keep an eye on your credit report and FICO® Credit Score. When it's time to get a loan, you want to make sure you get the credit amount - and the interest rate - that you deserve. And if those things are important to you, then it looks like your FICO® Credit Score too.

Read next post about Credit Report with FICO Credit Score.

0 Response to "Free Credit Report FICO® Score"

Post a Comment